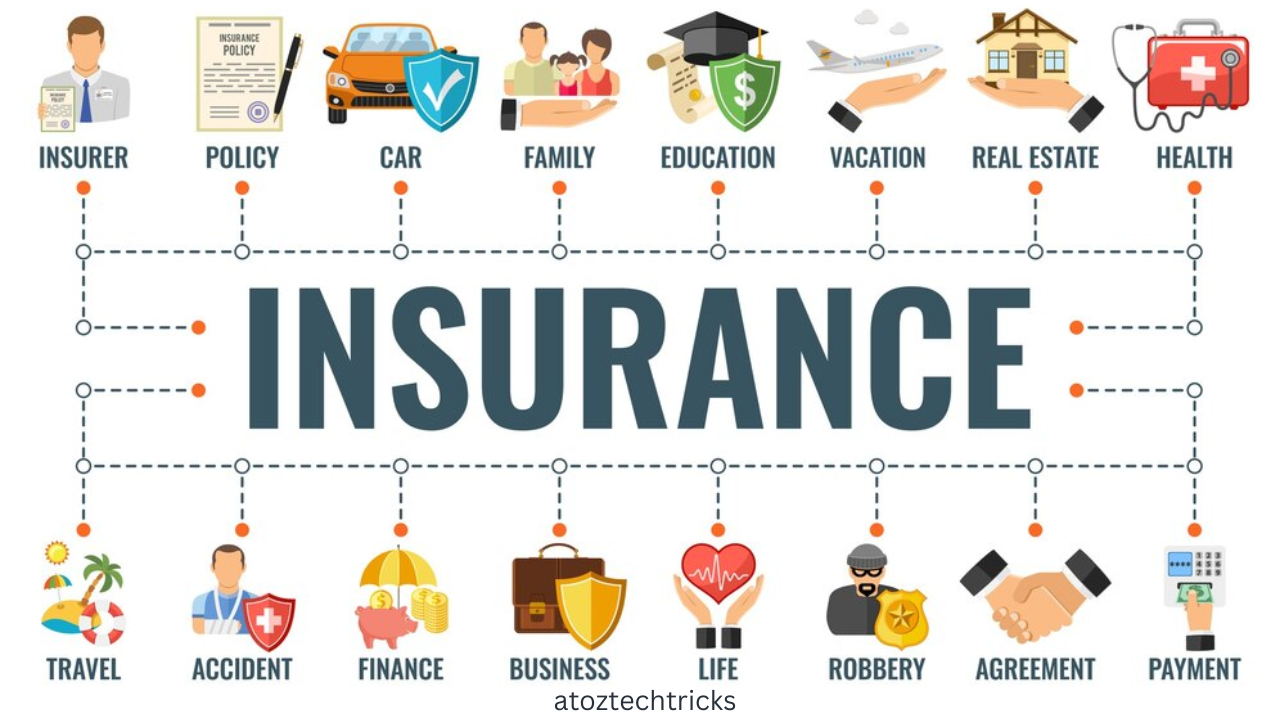

Types of Insurance Coverage: A Comprehensive Guide

Insurance coverage is a critical component of financial planning and risk management. It protects against various risks, helping individuals and businesses mitigate financial loss in uncertain situations. Understanding the different types of insurance coverage available can help you make informed decisions about which policies are necessary for your circumstances. In this comprehensive guide, we’ll explore the main types of insurance coverage, including health, auto, home, life, disability, and business insurance. We’ll also discuss some specialized forms of coverage and their importance.

1. Health Insurance

Overview

Health insurance is essential for covering medical expenses and ensuring access to healthcare services. It helps pay for doctor visits, hospital stays, prescription medications, and other medical treatments.

Types of Health Insurance Coverage

- Individual Health Insurance: Purchased by individuals for themselves or their families. Plans vary in terms of coverage, deductibles, and premiums.

- Group Health Insurance: Offered by employers to employees. Typically, premiums are shared between the employer and the employee.

- Medicare: A federal program for people aged 65 and older, and certain younger individuals with disabilities. It includes several parts:

- Part A: Hospital insurance.

- Part B: Medical insurance.

- Part C: Medicare Advantage plans, which combine Part A and Part B.

- Part D: Prescription drug coverage.

- Medicaid: A joint federal and state program providing health coverage for low-income individuals and families.

- Short-Term Health Insurance: Temporary coverage for individuals between jobs or waiting for other coverage to begin.

Why It’s Important

Health insurance protects you from high medical costs and provides access to a network of healthcare providers. Without it, even routine medical expenses can become a significant financial burden.

2. Auto Insurance

Overview

Auto insurance covers damages related to vehicles, whether from accidents, theft, or other incidents. It’s legally required in most places and can protect against significant financial loss from car accidents.

Types of Auto Insurance Coverage

- Liability Coverage: Covers bodily injury and property damage caused to others in an accident where you are at fault.

- Collision Coverage: Pays for damage to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision-related damage, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance.

Why It’s Important

Auto insurance is crucial for financial protection against accidents and damage. It ensures that you can handle the costs associated with vehicle repairs, medical bills, and legal expenses.

3. Home Insurance

Overview

Home insurance, or homeowners insurance, protects your residence and its contents from various risks. It also provides liability protection in case someone is injured on your property.

Types of Home Insurance Coverage

- Dwelling Coverage: This covers damage to your home’s structure due to covered perils like fire, windstorm, or vandalism.

- Personal Property Coverage: Protects belongings inside your home, such as furniture, electronics, and clothing, against theft or damage.

- Liability Coverage: Offers protection if someone is injured on your property or if you cause damage to someone else’s property.

- Additional Living Expenses (ALE): This covers the cost of temporary housing and other expenses if your home becomes uninhabitable due to a covered event.

- Flood Insurance: Not typically included in standard home insurance policies. It provides coverage for damage caused by flooding.

Why It’s Important

Home insurance safeguards your property and possessions against loss and provides liability protection. It also helps cover living expenses if your home is damaged and you need to live elsewhere while repairs are made.

Tax Planning for High-Net-Worth Individuals: Strategies for Maximizing Wealth Preservation

4. Life Insurance

Overview

Life insurance provides financial support to your beneficiaries in the event of your death. It can help cover funeral expenses, pay off debts, and provide ongoing income for your loved ones.

Types of Life Insurance Coverage

- Term Life Insurance: Provides coverage for a specified term (e.g., 10, 20, or 30 years). If you pass away during this term, your beneficiaries receive a death benefit. It’s generally more affordable than permanent life insurance.

- Whole Life Insurance: Offers coverage for your entire life, with a death benefit and a cash value component that grows over time. Premiums are typically higher than term life insurance.

- Universal Life Insurance: A flexible policy that combines a death benefit with a cash value component. It allows you to adjust your premiums and death benefit amounts.

- Variable Life Insurance: Includes a death benefit and a cash value component that can be invested in various securities. The cash value can fluctuate based on investment performance.

Why It’s Important

Life insurance ensures that your loved ones are financially protected in your absence. It can provide peace of mind knowing that your family will have the financial resources they need to maintain their quality of life.

5. Disability Insurance

Overview

Disability insurance provides income replacement if you become unable to work due to illness or injury. It’s crucial for maintaining financial stability if you experience a temporary or permanent disability.

Types of Disability Insurance Coverage

- Short-Term Disability Insurance: Offers coverage for a limited period, typically up to six months. It provides income replacement for short-term disabilities.

- Long-Term Disability Insurance: Provides coverage for extended periods, often until retirement age. It replaces a portion of your income if you’re unable to work for an extended time.

Why It’s Important

Disability insurance ensures that you have a financial safety net if you’re unable to work due to a disability. It helps cover living expenses and maintain your standard of living during periods of disability.

6. Business Insurance

Overview

Business insurance protects companies from various risks associated with operating a business. It helps cover financial losses due to property damage, legal claims, and other business-related risks.

Types of Business Insurance Coverage

- General Liability Insurance: Covers third-party bodily injury, property damage, and legal defence costs. It’s essential for protecting against claims of negligence or harm caused by your business operations.

- Property Insurance: Protects physical assets such as buildings, equipment, and inventory from damage due to fire, theft, or other covered perils.

- Professional Liability Insurance (Errors and Omissions Insurance): Covers claims related to professional errors or negligence. It’s especially important for service providers and consultants.

- Workers’ Compensation Insurance: Provides benefits to employees who are injured or become ill due to work-related activities. It covers medical expenses and lost wages.

- Business Interruption Insurance: This covers loss of income due to a temporary shutdown of your business caused by a covered event, such as a fire or natural disaster.

Why It’s Important

Business insurance protects your company’s financial stability and ensures that you can continue operations in the face of unexpected events. It’s vital for managing risks and maintaining business continuity.

Tax Planning for Self-Employed Individuals: A Comprehensive Guide

7. Specialized Insurance Coverage

Overview

In addition to the core types of insurance, there are various specialized coverages designed to address specific needs or risks. These policies can provide additional protection tailored to unique circumstances.

Types of Specialized Insurance Coverage

- Travel Insurance: Covers risks associated with travel, such as trip cancellations, medical emergencies abroad, and lost luggage.

- Pet Insurance: Helps cover veterinary expenses for pets, including medical treatments, surgeries, and medications.

- Identity Theft Insurance: Provides assistance and coverage for expenses related to identity theft, such as legal fees and fraudulent transactions.

- Umbrella Insurance: Offers additional liability coverage beyond the limits of your primary policies, such as auto or home insurance. It provides extra protection for significant claims or lawsuits.

- Cyber Insurance: Covers risks related to data breaches, cyberattacks, and other technology-related threats. It’s increasingly important for businesses in the digital age.

Why It’s Important

Specialized insurance coverage addresses unique risks that standard policies may not cover. It provides tailored protection for specific needs and enhances overall financial security.

Understanding the various types of insurance coverage is crucial for protecting yourself, your family, and your business against financial loss. Each type of insurance plays a vital role in managing risk and ensuring that you have the financial resources needed in times of need. By assessing your personal and business circumstances, you can choose the appropriate insurance policies to provide comprehensive coverage and peace of mind.

Whether it’s health, auto, home, life, disability, business, or specialized insurance, having the right coverage can make a significant difference in how you handle unexpected events and maintain financial stability. Take the time to evaluate your needs, compare policies, and consult with insurance professionals to ensure that you have the protection necessary to safeguard your assets and well-being.

Strategic Timing for Investments and Expenses: A Comprehensive Guide

Post Comment