Master Your Finances: Creating an Effective Monthly Budget

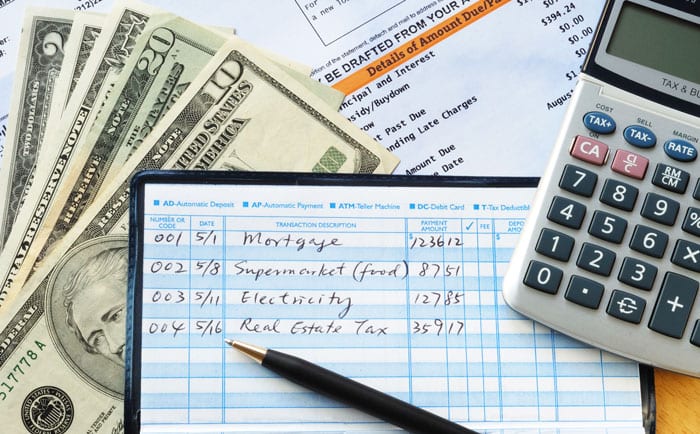

Managing personal finances can seem daunting, but with the right approach and tools, it can be a powerful way to take control of your financial future. One of the most essential tools in your financial arsenal is a well-planned and effective monthly budget. This guide will walk you through the steps to create a budget that works for you, helping you to achieve your financial goals, whether they include saving for a home, paying off debt, or building an emergency fund.

Understanding the Importance of a Monthly Budget

Before diving into the how-to of creating a monthly budget, it’s crucial to understand why budgeting is so important. A budget serves as a financial blueprint, providing a clear picture of your income and expenses. This clarity helps in making informed financial decisions, avoiding unnecessary debt, and ensuring that you’re living within your means.

The Benefits of Budgeting

- Financial Awareness: Budgeting helps you become more aware of where your money is going. This awareness is the first step in identifying areas where you can cut back and save more.

- Debt Reduction: By allocating funds specifically for debt repayment, a budget helps you stay on track with paying off debts, potentially saving you money on interest in the long run.

- Savings Growth: A budget enables you to allocate a portion of your income to savings, helping you build a safety net for emergencies and future financial goals.

- Stress Reduction: Knowing that your finances are under control can significantly reduce the stress associated with money management. A budget gives you a sense of control and peace of mind.

- Goal Achievement: Whether you’re saving for a vacation, a new car, or retirement, a budget allows you to plan and work towards achieving these goals systematically.

Exciting Healthcare Careers for a Fulfilling and Rewarding Future

Common Budgeting Myths

Before proceeding, it’s essential to address some common misconceptions about budgeting:

- Myth 1: Budgets are too restrictive.

Many people believe that budgeting means depriving themselves of all the things they enjoy. In reality, a budget helps you allocate funds for both needs and wants, allowing for financial freedom within boundaries. - Myth 2: Budgeting is only for people with financial problems.

Budgeting is beneficial for everyone, regardless of their financial situation. It’s a tool for managing money wisely, not just for getting out of debt. - Myth 3: Budgeting is too complicated.

While budgeting can seem complex at first, there are many tools and resources available to simplify the process. With practice, budgeting becomes second nature.

Steps to Creating an Effective Monthly Budget

Creating a monthly budget doesn’t have to be overwhelming. By following these steps, you can develop a budget that works for your unique financial situation.

1. Determine Your Financial Goals

The first step in creating a budget is to establish your financial goals. These goals will guide how you allocate your income and manage your expenses. Goals can be short-term (e.g., saving for a vacation), medium-term (e.g., paying off a car loan), or long-term (e.g., retirement savings).

- Short-term goals: These are goals you plan to achieve within the next year or two. Examples include building an emergency fund, paying off a credit card, or saving for a down payment on a car.

- Medium-term goals: These goals typically take three to five years to achieve. They might include saving for a home down payment, paying off student loans, or starting a business.

- Long-term goals: Long-term goals are those that take more than five years to achieve. Examples include saving for retirement, funding your children’s education, or paying off your mortgage.

2. Track Your Income and Expenses

The next step is to get a clear understanding of your current financial situation. This involves tracking your income and expenses.

- Income: List all sources of income, including your salary, freelance work, investments, and any other sources. Make sure to use your net income (after taxes and deductions) for a more accurate budget.

- Expenses: Track all your monthly expenses. These can be divided into fixed and variable expenses.

- Fixed expenses: These are expenses that stay the same each month, such as rent or mortgage payments, insurance premiums, and car payments.

- Variable expenses: These expenses can fluctuate from month to month, such as groceries, utilities, transportation, and entertainment.

Discover Your Potential: Exploring Careers in Medical Administration

3. Categorize Your Expenses

Once you’ve tracked your income and expenses, the next step is to categorize your expenses. This categorization will help you see where your money is going and identify areas where you can cut back if necessary.

- Essential expenses: These are the costs necessary for your basic needs, such as housing, utilities, groceries, transportation, and healthcare.

- Non-essential expenses: These include discretionary spending, such as dining out, entertainment, hobbies, and shopping. While these expenses aren’t necessary, they contribute to your quality of life.

- Savings and investments: Allocate a portion of your income to savings and investments. This category includes retirement savings, emergency funds, and other long-term financial goals.

4. Choose a Budgeting Method

There are several budgeting methods you can choose from, depending on your financial goals and personal preferences. Here are some popular options:

- The 50/30/20 Rule: This method allocates 50% of your income to essential expenses, 30% to non-essential expenses, and 20% to savings and debt repayment. It’s a simple and flexible approach that works well for many people.

- Zero-Based Budgeting: With this method, you assign every dollar of your income to a specific category, including savings. The goal is to have zero dollars left at the end of the month. This approach requires careful planning and tracking but can be very effective in controlling spending.

- Envelope System: This cash-based system involves putting money for each expense category into separate envelopes. Once the money in an envelope is gone, you can’t spend any more in that category for the month. It’s a hands-on way to manage money and avoid overspending.

- Pay-Yourself-First: This method involves prioritizing savings before paying for other expenses. You allocate a specific amount or percentage of your income to savings and investments first, then budget the remaining funds for your other expenses.

5. Create Your Budget

With your chosen budgeting method in mind, it’s time to create your budget. Start by listing your income at the top, followed by your expenses categorized into essential, non-essential, and savings/investments.

Make sure your expenses do not exceed your income. If they do, you’ll need to adjust your spending by cutting back on non-essential expenses or finding ways to increase your income.

Example Budget

Here’s a simplified example of what a budget might look like:

| Category | Budgeted Amount |

|---|---|

| Income | $4,000 |

| Essential Expenses | |

| Rent/Mortgage | $1,200 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $150 |

| Insurance | $150 |

| Healthcare | $100 |

| Non-Essential Expenses | |

| Dining Out | $100 |

| Entertainment | $150 |

| Shopping | $100 |

| Savings and Investments | |

| Emergency Fund | $300 |

| Retirement Savings | $200 |

| Debt Repayment | $350 |

| Total Expenses | $3,400 |

| Leftover | $600 |

In this example, the leftover amount can be allocated towards additional savings, debt repayment, or other financial goals.

6. Monitor and Adjust Your Budget

Creating a budget is not a one-time task. It’s important to monitor your budget regularly to ensure you’re staying on track. Review your expenses at the end of each month and compare them to your budget. If you’ve overspent in a category, look for ways to adjust your spending the following month.

You should also adjust your budget as your financial situation changes. For example, if you get a raise, you might allocate more money towards savings or debt repayment. If your expenses increase, you might need to cut back on other areas to stay within your budget.

7. Automate Your Finances

One of the most effective ways to stick to your budget is to automate your finances. This can include setting up automatic transfers to your savings account, scheduling automatic bill payments, and using budgeting apps to track your spending.

Automation reduces the risk of forgetting to pay a bill or failing to save, making it easier to stick to your financial plan. It also frees up time and mental energy, allowing you to focus on other aspects of your life.

8. Use Budgeting Tools and Apps

- Personal Capital: Personal Capital combines budgeting with investment tracking. It offers tools for both managing your budget and planning for retirement, making it a comprehensive financial management solution.

- GoodBudget: GoodBudget uses the envelope budgeting system in a digital format. It allows you to allocate funds into virtual envelopes for different spending categories, helping you manage your cash flow effectively.

Each of these tools offers unique features, so consider your personal preferences and financial goals when choosing the best option for you.

9. Set Up an Emergency Fund

One of the most crucial aspects of financial planning is having an emergency fund. This fund acts as a financial safety net in case of unexpected expenses, such as medical emergencies, car repairs, or job loss.

- How Much to Save: Financial experts generally recommend saving three to six months’ worth of living expenses in your emergency fund. This amount provides a buffer that can cover essential expenses during a financial crisis.

- Where to Keep It: Keep your emergency fund in a separate, easily accessible account, such as a high-yield savings account. This ensures that the funds are available when you need them but are not easily accessible for everyday spending.

Unlocking Potential: Exploring the Diverse and Dynamic Careers in Physical Therapy

10. Plan for Irregular Expenses

Not all expenses are monthly or predictable. Irregular expenses, such as annual insurance premiums, car maintenance, or holiday gifts, can disrupt your budget if you’re not prepared for them.

- Create a Sinking Fund: A sinking fund is a savings account specifically designated for irregular or anticipated expenses. Set aside a small amount of money each month to build up this fund, so you’re prepared when these expenses arise.

- Budget for the Unexpected: Include a category in your budget for miscellaneous or unexpected expenses. This category can help you manage costs that don’t fit neatly into other categories.

11. Review and Adjust Your Budget Regularly

Creating a budget is just the beginning. Regularly reviewing and adjusting your budget ensures that it remains relevant and effective.

- Monthly Reviews: At the end of each month, review your spending and compare it to your budget. Identify any areas where you’ve overspent or underspent and make adjustments as needed.

- Adjust for Life Changes: Significant life events, such as a new job, moving to a new city, or having a child, can impact your financial situation. Adjust your budget to reflect these changes and ensure it continues to meet your needs.

- Annual Reviews: Conduct a comprehensive review of your budget and financial goals at least once a year. This review helps you assess your progress and make long-term adjustments to your budget.

12. Seek Professional Advice if Needed

While creating and managing a budget can be done independently, some situations may benefit from professional advice. Financial advisors can offer personalized guidance and help you develop a more comprehensive financial plan.

- When to Seek Help: Consider consulting a financial advisor if you have complex financial situations, such as significant investments, high levels of debt, or specific tax concerns. An advisor can provide expert insights and strategies tailored to your unique circumstances.

- Choosing a Financial Advisor: Look for advisors with relevant credentials, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Ensure they have a fiduciary responsibility to act in your best interest.

13. Maintain Financial Discipline

Creating a budget is a significant step, but maintaining discipline is key to its success. Here are some tips for staying on track:

- Avoid Impulse Purchases: Before making a purchase, ask yourself if it aligns with your budget and financial goals. Give yourself time to evaluate whether the expense is necessary.

- Stick to Your Plan: Resist the temptation to deviate from your budget. If you do make an unplanned purchase, adjust your budget in other areas to compensate.

- Stay Motivated: Regularly remind yourself of your financial goals and the benefits of sticking to your budget. Celebrate small victories and progress towards your goals.

14. Educate Yourself About Personal Finance

Continuous learning about personal finance can enhance your budgeting skills and overall financial management. There are numerous resources available to help you expand your knowledge:

- Books: Books such as “The Total Money Makeover” by Dave Ramsey or “Your Money or Your Life” by Vicki Robin offer valuable insights into personal finance and budgeting.

- Online Resources: Websites like Investopedia, NerdWallet, and The Balance provide articles, calculators, and tools to help you understand financial concepts and manage your budget.

- Financial Blogs and Podcasts: Many personal finance experts share tips and advice through blogs and podcasts. Follow reputable sources to stay informed about financial trends and strategies.

Creating an effective monthly budget is a powerful way to take control of your finances and work towards achieving your financial goals. By understanding the importance of budgeting, tracking your income and expenses, choosing a budgeting method, and regularly reviewing your budget, you can build a strong foundation for financial stability and success.

Explore Exciting and Essential Medical Laboratory Careers Today

Remember that budgeting is an ongoing process. It requires regular attention, adjustments, and discipline to ensure that it continues to meet your needs and support your financial goals. With dedication and the right tools, you can master your finances and achieve a secure and prosperous financial future.

Post Comment